The Ultimate Guide To Life Insurance In Dallas Tx

Wiki Article

The Of Commercial Insurance In Dallas Tx

Table of ContentsSome Known Factual Statements About Life Insurance In Dallas Tx See This Report about Commercial Insurance In Dallas Tx7 Easy Facts About Health Insurance In Dallas Tx DescribedThe Definitive Guide to Life Insurance In Dallas Tx

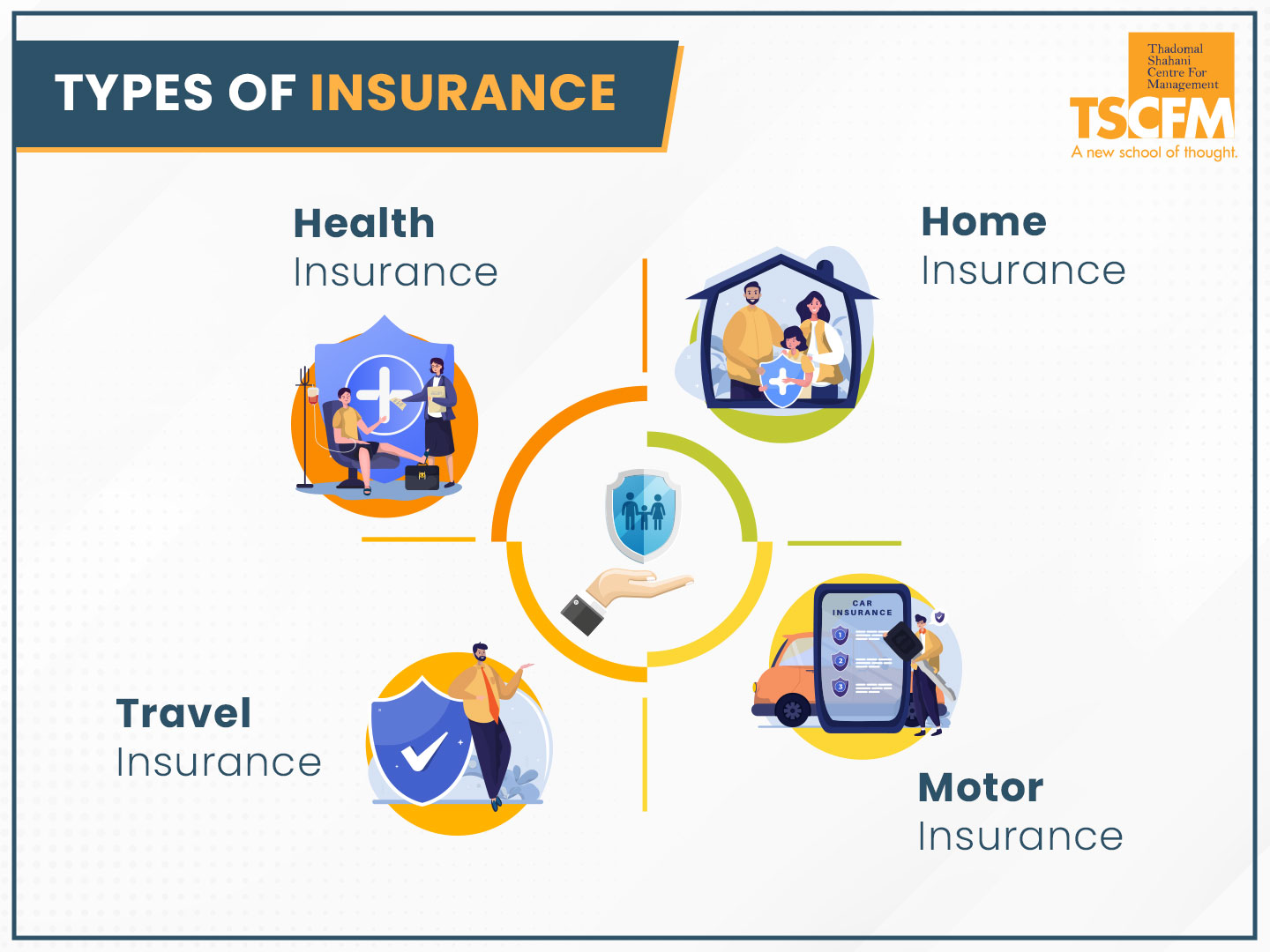

There are various insurance plan, and also knowing which is ideal for you can be tough. This overview will talk about the different kinds of insurance and what they cover. We will also give suggestions on choosing the best policy for your needs. Table Of Contents Health insurance policy is one of the most essential types of insurance that you can have.If you have any concerns regarding insurance policy, call us as well as request a quote. They can help you choose the right policy for your demands. Get in touch with us today if you desire tailored service from a licensed insurance agent - Life insurance in Dallas TX.

Below are a few reasons why term life insurance coverage is the most popular kind. The price of term life insurance coverage costs is determined based on your age, health, as well as the insurance coverage amount you call for.

HMO strategies have lower monthly premiums as well as lower out-of-pocket prices. With PPO plans, you pay greater monthly costs for the freedom to utilize both in-network as well as out-of-network suppliers without a recommendation. PPO strategies can lead to higher out-of-pocket medical costs. Paying a premium is comparable to making a month-to-month car settlement.

The Only Guide for Life Insurance In Dallas Tx

When you have a deductible, you are in charge of paying a particular quantity for coverage services prior to your health insurance plan gives insurance coverage. Life insurance policy can be split right into 2 primary kinds: term and also irreversible. Term life insurance coverage offers protection for a specific period, usually 10 to 30 years, and is much more affordable.We can't stop the unforeseen from happening, however in some cases we can protect ourselves as well as our households from the worst of the financial fallout. 4 types of insurance coverage that many economic professionals recommend include life, health, car, and also long-term impairment.

It consists of a death benefit as well as also a cash value component. As the value expands, you can access the money by taking a finance or withdrawing funds and you can finish the plan by taking the cash worth of the policy. Term life covers you for a set quantity of time like 10, 20, or three decades as well as your costs remain secure.

2% of the American populace lacked insurance policy coverage in 2021, the Centers for Disease Control (CDC) reported in its National Center for Health Stats. More than 60% obtained their insurance coverage via an employer or in the personal insurance coverage marketplace while the rest were covered by government-subsidized programs including Medicare and also Medicaid, professionals' benefits programs, and the federal industry developed under the Affordable Treatment Act.

Some Known Details About Home Insurance In Dallas Tx

According to the Social Security Administration, one in four workers getting in the labor force will certainly become disabled before they get to the age of retired life. While wellness insurance pays for a hospital stay as well as medical costs, you link are usually burdened with all of the expenses that your income had covered.

Nearly all states need chauffeurs to have auto insurance and minority that don't still hold vehicle drivers financially in charge of any damage or injuries they trigger. Visit Your URL Here are your alternatives when purchasing auto insurance policy: Obligation insurance coverage: Spends for property damages and injuries you cause to others if you're at mistake for a crash and likewise covers litigation costs as well as judgments or negotiations if you're taken legal action against since of a vehicle mishap.

Employer protection is often the most effective option, however if that is unavailable, acquire quotes from a number of carriers as numerous provide price cuts if you purchase more than one sort of protection.

3 Easy Facts About Truck Insurance In Dallas Tx Explained

The best policy for you will certainly rely on your individual situations, how much coverage you need, and exactly how much you wish to pay for it. This overview covers the most usual kinds of life insurance policy plans on the market, including info on just how they function, their pros and cons, for how long they last, as well as who they're ideal for.

This is one of the most popular sort of life insurance policy for most individuals since it's inexpensive, just lasts for as long as you require it, as well as comes with couple of tax obligation policies and limitations. Term life insurance is among the most convenient as well as least expensive means to supply a monetary safety and security web for your enjoyed ones.

You pay premiums toward the policy, as well as if you die during the term, the insurance policy company pays a set quantity of cash, known as the fatality benefit, to your marked recipients. The survivor benefit can be paid as a lump amount or an annuity. The majority of people choose to obtain the death benefit as a round figure to stay clear of paying tax obligations on any type of gained passion. Home insurance in Dallas TX.

Report this wiki page